Smart-shoring gives neobanks and fintechs competitive advantage over their less flexible traditional competitors

We have previously looked at how organisations can mitigate risk and manage cost without compromising on a great customer experience with a smart-shoring strategy for their contact centre operations.

It’s tough competing against traditional banks with their huge reach and branch networks, massive marketing budget and name recognition. Neobanks, digital banks that operate solely online, compete mainly on the convenience they offer over traditional banks, with a digital, streamlined, frictionless customer experience.

For these organisations, having the right smart-shoring strategy can be a huge competitive advantage.

When customers call in to the contact centre, it’s usually a sign that something hasn’t worked as it should. For organisations that differentiate themselves by the service they offer, neobanks have to respond quickly and efficiently. At the same time, margins are always tight, so cost is an important factor.

Neobanks and other fintech start-ups already have one source of competitive advantage over traditional banks that is built right into their DNA. Their start-up culture, tech-savviness, lack of physical limitations, and absence of legacy technology all make them far more flexible operationally. Our advice is to double down on that.

Reshoring for competitive advantage

Particularly since the start of the pandemic, when most offshore contact centre destinations had to shut down and were unable to move quickly enough to a work from home model, many Australian companies began to bring contact centre and customer service activity back from overseas.

There were several reasons for this. The first was, of course, immediate continuity of service. For larger corporations that are in the public eye there was also PR value in bringing jobs back to Australia at a time of national crisis.

Two years further down the line, those same organisations are realising the advantages of providing a higher level of service and improved customer experience. Onshore contact centres are better at handling more complex and sensitive customer queries as they are experiencing the same situation as their customers.

For neobanks, it can also provide a familiar voice to their customer without having a physical presence and provide the same, if not better, level of service and customer experience as traditional banks.

This has really upped the stakes for everyone in the banking and financial services sector.

A hybrid strategy delivers the best of all worlds

For cost reasons, neobanks are under pressure to offshore costly human resources intensive functions. Neobanks serve their customers remotely, which means operations can be located almost anywhere. It’s tempting therefore to locate almost everything offshore and benefit from the lower cost of operations, including office rent and labour hire.

This would be a mistake however, particularly as traditional banks are in the process of doing exactly the opposite to improve the customer experience. Neobanks that offshore all CX functions can lose out to the traditional banks on quality of service.

Instead, a hybrid strategy gives neobanks all the benefits of onshore and offshore (and automation) while mitigating most of the increased costs. In fact, as increased performance translates into higher NPS and CSat scores, increased customer retention, and potentially an uptick in customer lifetime value, we believe this strategy is more profitable for a digital bank’s bottom line.

Simply offshoring everything is only acting on the costs side of the equation. But contact centres are no longer cost centres; they are centres of value creation. Impacting both sides of the equation delivers by far the biggest gains.

What a hybrid shoring strategy looks like

When you have the flexibility of operations that a digital bank or fintech start up has (or should have), you can decide exactly how you want to operate to get the best outcomes for your customers and business. You are not tied to a branch network, outdated computer systems, or legacy software.

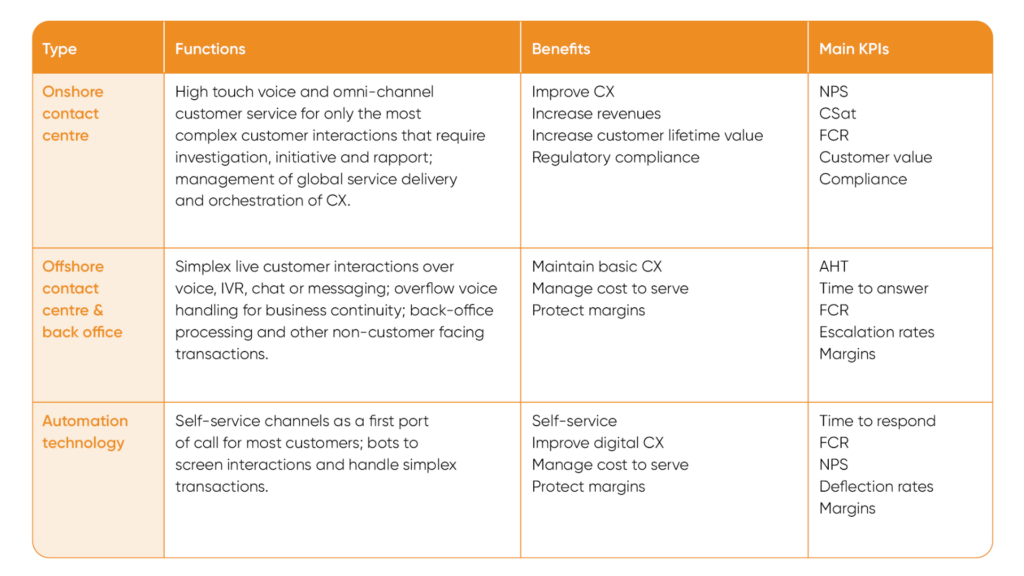

Your hybrid deployment model could therefore look something like this:

The benefit of this strategy is that you can use the right type of resources to nudge all the different indicators in the direction most favourable to your business. For example, offshoring might reduce cost to serve but it generally does so by negatively impacting quality of service indicators.

With this more flexible hybrid model you benefit from reducing cost to serve for simplex interactions by using offshore and automation, while simultaneously improving customer outcomes by handling the more complex and valuable customer interactions – which have the most impact on customer satisfaction – from your onshore centre.

At the same time, you keep management and orchestration onshore where it is close to your customers, your home culture, and your regulatory environment in order to maintain quality and compliance.

TSA are Australia’s market leading specialists in CX Consultancy and Contact Centre Services. We are passionate about revolutionising the way brands connect with Australians. How? By combining our local expertise with the most sophisticated customer experience technology on earth, and delivering with an expert team of customer service consultants who know exactly how to help brands care for their customers.